Not known Details About Offering More Than Asking Price

Table of ContentsThe 30-Second Trick For Offering More Than Asking Price3 Easy Facts About Offering More Than Asking Price ExplainedThe Buzz on Offering More Than Asking PriceThe Ultimate Guide To Offering More Than Asking PriceOffering More Than Asking Price Can Be Fun For AnyoneRumored Buzz on Offering More Than Asking Price

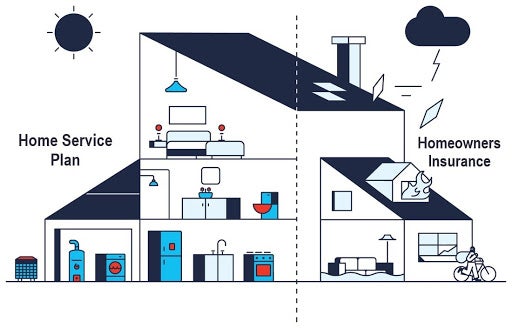

Have you ever before wondered what the distinction was between a home guarantee as well as home insurance policy? Both protect a house and also a property owner's wallet from expensive repairs, yet what exactly do they cover? Do you need both a house service warranty and house insurance coverage, or can you obtain simply one? Every one of these are outstanding concerns that numerous home owners ask.

What is a residence service warranty? A home service warranty secures a residence's interior systems as well as home appliances. While a residence guarantee contract is comparable to residence insurance policy, especially in exactly how a home owner uses it, they are not the exact same thing. A homeowner will pay a yearly costs to their residence guarantee company, normally in between $300-$600.

Offering More Than Asking Price Fundamentals Explained

What does a house guarantee cover? A house warranty covers the major systems in a home, such as a residence's heating, cooling, pipes, as well as electrical systems. A home warranty may also cover the bigger devices in a house like the dish washer, oven, fridge, clothing washer, and dryer. House service warranty business usually have different plans available that provide protection on all or a choose few of these things - offering more than asking price.

As an example, if a commode was dripping, the residence service warranty business would pay to deal with the bathroom, but would not pay to fix any kind of water damage that was triggered to the framework of the house because of the leaking toilet. Fortunately, it would be covered by insurance. What is residence insurance? If a homeowner has a home loan on their home (which most home owners do) they will be needed by their mortgage lender to purchase residence insurance coverage.

Not known Facts About Offering More Than Asking Price

House insurance policy might also cover medical expenses for injuries that individuals sustained by being on your residential property. When something is damaged by a disaster that is covered under the home insurance coverage policy, a home owner will certainly call their home insurance coverage firm to file an find insurance claim.

Homeowners will usually need to pay an insurance deductible, a set quantity of cash that appears of the property owner's pocketbook prior to the house insurance coverage company pays any money towards the claim. A residence insurance policy deductible can be anywhere in between $100 to $2,000. Typically, the higher the deductible, the reduced the annual premium cost - offering more than asking price.

What is the Distinction In Between Residence Guarantee and Residence Insurance A house service warranty contract and also a home insurance plan operate in similar ways. Both have a yearly premium and also a deductible, although a home insurance coverage premium and also deductible is typically much greater than a residence guarantee's. The main distinctions between residence warranties and residence insurance coverage are what they cover.

The Only Guide to Offering More Than Asking Price

An additional Read Full Article difference between a residence warranty as well as home insurance policy is that home insurance is typically needed for house owners (if they have a home loan on their residence) while a home service warranty strategy is not called for. A home guarantee and home insurance coverage give security on various components of a residence, and also with each other they can safeguard a house owner's spending plan from pricey repairs when they certainly crop up.

They will certainly function with each other to provide security on every part of your house. If you want buying a residence service warranty for your home, have a look at Landmark's house warranty strategies and also prices right here, or request a quote for your house next page here.

The 8-Minute Rule for Offering More Than Asking Price

"Nonetheless, the more systems you include, such as swimming pool insurance coverage or an extra furnace, the higher the cost," she claims. Includes Meenan: "Prices are typically negotiable also." Apart from the annual cost, property owners can anticipate to pay usually $100 to $200 per service call browse through, relying on the type of contract you buy, Zwicker notes.

Residence guarantees don't cover "things like pre-existing conditions, pet infestations, or remembered products, discusses Larson. This is the time to take a close appearance at your protection due to the fact that "the exemptions vary from program to program," says Mennan."If individuals do not read or recognize the protections, they might finish up believing they have protection for something they don't."Evaluation protections and also exemptions throughout the "free look" period.

"We paid $500 to subscribe, and afterwards needed to pay an additional $300 to clean the primary sewer line after a shower drainpipe back-up," claims the Sanchezes. With $800 out of pocket, they believed: "We really did not benefit from the residence warranty in any way." As a young couple in one more home, the Sanchezes had a difficult experience with a residence warranty.

Offering More Than Asking Price Can Be Fun For Anyone

When the service technician had not been satisfied with a reading he obtained while testing the furnace, they say, the firm would certainly not consent to insurance coverage unless they paid to change a $400 part, which they did. While this was the Sanchezes experience years back, Brown confirmed that "examining every major home appliance before providing coverage is not a sector criterion."Constantly ask your supplier for clarity.